Why Kolkata doesn’t have a Unicorn ?

ircc

Post On > Jan 28 2023 4535

The start-up revolution has taken India by storm. Proactive policy measures taken by the Narendra Modi government have paid off. Programmes like Stand-Up India or Start-Up India, Make-in-India and Digital India coupled with big-ticket reforms like Goods and Services Tax (GST) and rapid improvement in infrastructure created space for new-age entrepreneurship.

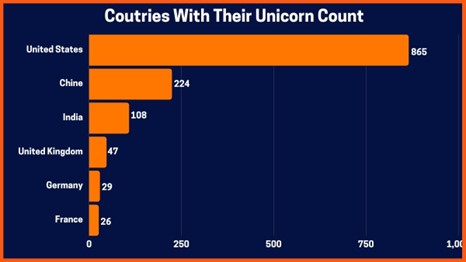

India had only 471 start-ups in 2016. As in July 2022, India had over 72,000 registered start-ups employing over 767,000 people. They are working in a wide range of areas from agri-marketing or agro-tech, to defence, space, e-commerce etc. The number of unicorns, increased from four in 2014 to 104 in 2022. An unicorn is an unlisted company valued over $1 billion.

West Bengal and Kolkata caught up with the national trend. From barely 8 in 2016, the number of start-ups in the state crossed 2300 in 2022. Of the total, nearly half came into being in 2021 and 2022. As a norm, most of these initiatives are based out of Kolkata and employ over 22,000 people.

However, the story has certain gaps. Kolkata was India’s top industrial and financial centre till the 1960s. The first software part of the country was developed in the city in the mid-1980s. It was one of the first four metropolises from where mobile services were launched in the 1990s. Till the advent of electronic trading in the 1990s, Kolkata had the country’s second-largest stock market after Mumbai.

True, the industrial and commercial prominence of Kolkata is diluted over the years. However, it is the country’s oldest education hub. At least four topmost higher educational institutes – Indian Institute of Technology (IIT), Indian Institute of Management (IIM), Indian Statistical Institute (ISI) and, Indian Institutes of Science Education and Research (IISER) – are located in and around Kolkata. This is apart from scores of other prominent higher educational institutes and research facilities in various fields of science and technology.

All these indicate that the state and the city should have steady access to quality human resources, which is crucial for start-up growth.

Start-Up: West Bengal Vs India (July 2022)

| Name of State | Population (million) | Start-Up | Start-up employment |

| Delhi | 32.9 | 8638 | 87,643 |

| Gujarat | 62.7 | 4920 | 51,193 |

| Haryana | 25.3 | 3985 | 48,843 |

| Karnataka | 64.1 | 8881 | 1,03,541 |

| Maharashtra | 112.4 | 13519 | 1,46,132 |

| Odisha | 43.7 | 1329 | 14,019 |

| Rajasthan | 78.2 | 2299 | 24,599 |

| Tamil Nadu | 72.1 | 3953 | 39,832 |

| Telangana | 35.1 | 3875 | 44,649 |

| West Bengal | 97.6 | 2301 | 22,419 |

| All India | 1407.6 | 72993 | 7,67,754 |

To be precise, Kolkata and West Bengal is far better positioned (or privileged) than the rest of the Eastern, Northeastern and central Indian states; which lack both industrial and educational legacy.

Comparison with Uttar Pradesh is distortionary. UP is India’s largest state with more than twice the population of West Bengal. The Western part, closer to Delhi, is developed, but the Eastern part of UP is as backward as Bihar in every sense of the term.

Given the above, the number of start-ups is way less than its potential in West Bengal. On a per-capita basis, Bengal has fewer start-ups than Odisha, which has come up in the country’s industrial and IT map only a decade or more ago.

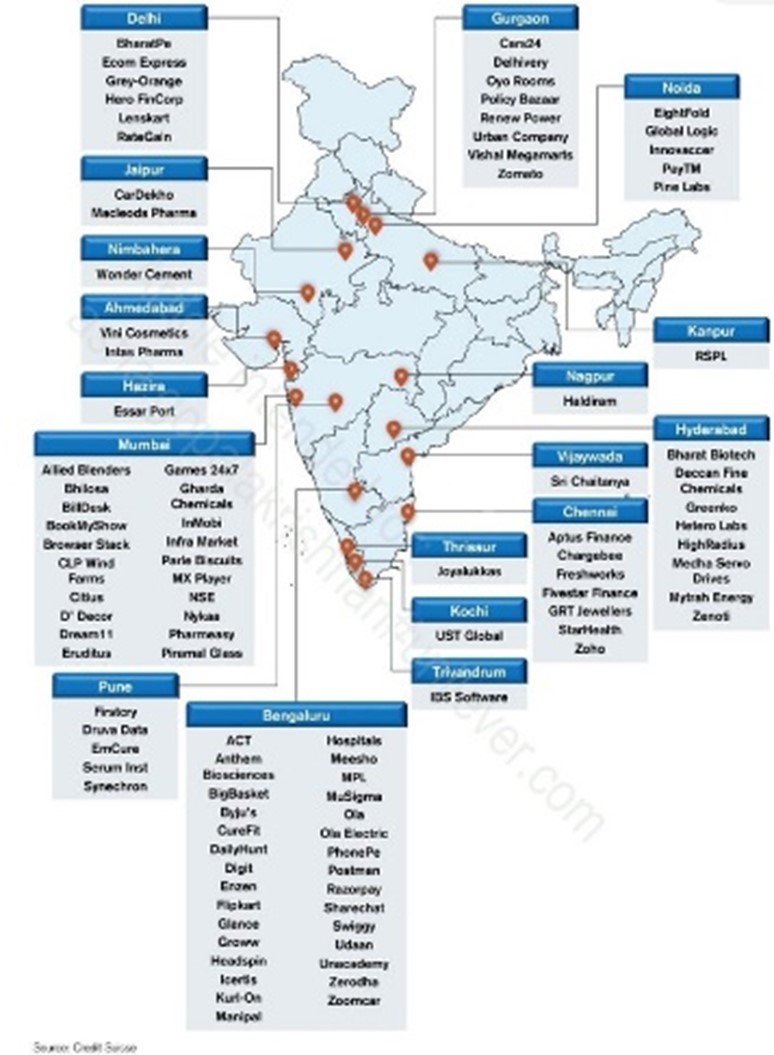

Nine cities in India had a population of over 4 million in the 2011 census. Of them, only Kolkata and Surat (Gujarat) do not have a unicorn. Gujarat is India’s top industrialised state and has at least two unicorns from Ahmedabad. West Bengal has none. In comparison, industrially backward Kerala has three unicorns. Overall, 18 cities in India have unicorns.

The presence of unicorns signifies the scale of operation and ability to attract investors’ finance. Both are crucial for the success of start-ups. Without the rapid increase in scale, a start-up will remain a small and medium enterprise.

That Kolkata is low on start-up concentration and does not have any unicorns, therefore, indicates structural hurdles limiting the scalability of start-up operations from the state.

Iravati Research and Communication Centre tried to understand the issues involving start-up operations in the state, through a discussion round with three prominent, first-generation, Kolkata-based entrepreneurs.

Of the three, Shantanu Som is an IT veteran. He left his in Railways to set up his Kolkata-based software OEM, Somnetics nearly three decades ago when there was barely any policy support to new initiatives. Today, Somnetics caters to clients across the country and abroad. However, the local economy has zero contribution to his turnover.

The story remains the same for Angshuman Bhattacharya’s SIBIA Analytics and Dr Arindam Saha’s Vista Intelligence. Both are into analytics and prediction. West Bengal has little contribution to their respective businesses.

Founded in 2013, SIBIA offers machine learning solutions related to consumer behaviour. It is acquired by Adani Enterprises at Rs 14.8 crore ($1.8 million at the current exchange) in December 2022. Adani has plans to increase the bench strength from the current 50.

Arindam’s Vista Intelligence started operations in 2021. Currently, they are into financial and consumer analytics. Vista will next enter bioinformatics and sports analytics. He has already raised the second round of funding and has a 20% stake by Jubilant group, the master franchise of Domino’s Pizza in India.

One can understand, an IT-OEM living on offshore clients. But predictive analytic solutions are the lifeline of a growing economy. From FMCG to banking and finance, stock brokers or the entertainment industry everyone needs such tools for efficient decision-making. Why shouldn’t they sell in Kolkata?

There may be many reasons for it. First, the state doesn’t have the headquarters of many successful large corporates. Even those who have registered offices in Kolkata have shifted the base of critical operations to more important cities. India’s top battery maker Exide, for example, has its registered office in Kolkata but the marketing head sits in Mumbai.

To be precise, corporates may have their back or sales offices in the city but decision-makers are in other locations. It means a start-up has to be visible in those locations to tap the market opportunity. For a small initiative, running on a shoestring budget, it's not possible to open multiple offices. It is better to shift to the location where his customer is.

The locational disadvantage cuts both ways. A low corporate base also means, low availability of senior-level talent - which is important for scale - and, a low population of deep-pocket investors who comes in at the 2nd or 3rd round of funding. And, the bigger the size of the funding, the more careful are the investors.

The problem doesn’t lie with the talent of start-up founders or the product they develop. Shantanu remembered a successful IT initiative, catering to the finance sector, moving out of Kolkata as they struck a major deal with a bank. They moved to the same city where the bank is headquartered.

Angshuman reminded us that investors prefer geographical proximity to maintain close tabs on the start-ups they are backing. This is also important for mentoring. According to him, it is a difficult task to raise as modest as $1 million (Rs 8 crore) finance from Kolkata. He is clear that till such time the funding issues are resolved Kolkata may not get its first unicorn.

You may watch the full discussion here:

Other panellists supported Angshuman's views but with a rider. Arindam felt that the market issues are equally important. Vista, he said is lucky that its investors allowed it to be run from Kolkata. However, as he launches the bioinformatics and sports analytics products, he might run out of luck.

The buyer/investor community in such products are based out of Bangalore, Hyderabad or Gujarat etc. For visibility, it might be essential for Vista to shift base. The initial advantages of starting operations from Kolkata even out in 2-3 years. As you scale up, the disadvantages of Kolkata become more apparent, he said.

Both the factors of the market and fund-raising opportunity are linked to a crucial indicator, the per-capita income of the state. If West Bengal doesn’t have an industrial base so does Kerala. However, Bengal’s per capita NSDP (net state domestic product) at current prices is 17% below the national average. Kerala’s per capita is 41% higher than the national average.

The difference between the two is evident in the share and size of organised economic activity in Kerala vis-à-vis Bengal. The southern state has a distinctly large retail sector. India’s largest shopping mall - Lulu International Shopping Mall - is situated in Kochi. The promoters of Lulu are from Thrissur.

As an end result, Kerala has multiple unicorns. Top jewellery brand Joyalukkas is based out of Kerala. West Bengal doesn’t have such examples.

In the end, therefore, the start-up revolution is closely linked to the overall economic health and aspirations of the land. West Bengal has to find answers to both to see meaningful change in the start-up landscape. ***

123

2025-07-27 20:33:14

asd

2025-07-27 20:31:39

Northeast Energy Scenario Part-1: Paradigm shift in petroproduct availability and consumption

2023-03-28 16:22:05

Consolidation of 'indigenous' votes aligned Tripura's political landscape with the rest of the northeast.

2023-02-16 08:51:53

Why Kolkata doesn’t have a Unicorn ?

2023-01-28 09:53:57

Social media literacy should be mandatory in UG curriculum

2022-11-30 12:00:53

Now, Stake Casino has become a favoured site for gamblers in India. To securely access the platform, simply open the official entry point here — Claim exclusive daily rewards at Stake Casino India 2025 instantly . It’s the easiest way to begin. With a diverse selection of slots, a smooth interface, and INR-friendly payments, the casino remains a leader in the digital casino industry. “Enjoy popular slots and win big instantly!” Stake Sign-Up in India | Quick & Easy Start Signing up at Stake is straightforward, allowing Indian players to place your first bets within minutes. Just follow the access point through the trusted entry mentioned earlier, then select Join Now, complete the form, activate your profile, and finally add funds to unlock the platform. “Sign up in a minute and get your free spins!” Stake Offers for Indian Players | Unlock Attractive Benefits The initial promotion is among the biggest advantages new users choose Stake. Players from India can instantly boost their bankroll with offers tailored for the local audience. • Welcome Bonus Package — Enjoy extra funds up to the maximum bonus limit. • Free Spins Offers — Enjoy additional spins on selected games. • VIP & Loyalty Program — Climb the VIP ladder for active gaming, then unlock exclusive perks. “Grab a 100% bonus to explore the casino!”

Now, Stake Casino has become a popular choice for gamblers in India. To start playing safely, simply open the official entry point here — Experience Stake Casino India 2025 for fair and secure gaming . It’s the safest method to begin. With thousands of exciting games, a smooth interface, and local transaction options, the casino excels in the competitive iGaming market. “Enjoy live dealer tables and win big instantly!” Stake Sign-Up in India | Simple Setup Registering at Stake is lightning-fast, allowing Indian players to begin your gaming journey within minutes. Just open the official page through the link provided above, then click the Sign Up button, complete the form, activate your profile, and finally make your first deposit to grab your welcome bonus. “Sign up in a minute and get your free spins!” Stake IN Promotions | Unlock Lucrative Promotions The sign-up reward is among the biggest advantages new users choose Stake. Players from India can instantly increase their balance with offers tailored for the local audience. • Welcome Bonus Package — Get a 100% match up to the maximum bonus limit. • Free Spins Offers — Enjoy additional spins on top slots. • VIP & Loyalty Program — Earn points for active gaming, then unlock exclusive perks. “Grab a 100% bonus to explore the casino!”

Iravati Research and Communication Centre LLP (IRCC) is a Kolkata-based think-centre, engaged in research and policy advocacy.

Useful Links

Email : info@ircc.in

Copyright © 2020 - IRCC - All rights reserved. Developed by Thinkbizz Marcom PVT LTD

Complaint Registration

Terms of Usage

IRAVATI RESEARCH AND COMMUNICATION CENTRE LLP, a limited liability partnership (LLP Identification No. AAO-4910) registered as on 11-03-2019, having registered address at 1050/2, Survey Park, Flat No.- B 8/10, Cal-Green, MIG-B, Phase-II, Kolkata-700075, India.

The mentioned Terms for the usage may apply to the functional website that you have viewed within www.ircc.in before clicking on these Terms of Use. This single website is referred to in this Terms of Use as "this Website."

Thereby using the website, you agree to these Terms of Use. Whereas if you do not agree to these Terms of Use, you are not permitted to use this website, and you must terminate your use immediately.

The "Iravati Research and Communication Centre Network" refers to the Iravati Research and Communication Centre LLP ("IRCC"), IRCC member firms, and related organizations.

The Iravati Research and Communication Centre LLP is an organization within the IRCC Network that provides this website and is referred to by these Terms of Use as "we", "We", or "our". While parts of these Terms of Use may refer to other features of the Iravati Research and Communication Centre Network, these Terms of Use are between you and us and not from any of those other organizations.

This website provides you with other features (free) of cost and better browsing. Furthermore, the user can choose to apply an additional part by subscribing to this website to their device with notifications.

htmlFor the sake of clarity, this website includes additional features, if any, (i) they do not solicit any form (ii) they are not intended to provide any service or product to users anywhere (iii) sponsor any services, advice or product and the user is required to exercise his / her understanding. , where necessary.

Content usage; Limitations; Privacy Statement

Notwithstanding otherwise expressing relevant content, and provided that you comply with all of your obligations under these Terms of Use, you are authorized to view, copy, print and distribute (but not modify) the content on this website; provided that (i) such use is htmlFor informational, non-commercial purposes only, (ii) any copy of the content you are making must include a copyright notice or other aspect of the content and, (iii) appropriate courtesy and proper referencing to the website should be given.

Intellectual Property Rights :

No use of the words or logos of the Iravati Research and Communication Centre has been permitted unless otherwise mentioned.

The content on this website is the original work and content of IRCC or any other entities within the IRCC network. We and our licensors retain all rights not expressly granted in these Terms of Use.

"Iravati Research and Communication Centre",the logo of Iravati Research and Communication Centre, and local language used above, and certain product names appearing on this website (collectively, "Iravati Research and Research Centre Marks"), are intellectual and intangible properties of Iravati Research and Communication Centre.

Unless provided in these Terms of Use, you are not consented to use any Iravati Research and Communication Centre Signs alone or in combination with other brands or building materials, including, in any media, advertising, or other promotional or marketing materials. or media, either in writing, orally, electronically, visually or in any other way.

Any view published on the website as presented by any personnel should be considered as the expression by the personnel only and not the standpoint of the organisation.

All contents of this website are original content and belongs to the Iravati Research and Communication Centre Network.

The trademarks of other parties to this website are htmlFor the sole purpose of identifying and not indicating that these individuals have endorsed this website or any of its content. These Terms of Use do not entitle you to use any of the trademarks of any other party.

Disclaimers and Limitations of Liability

This website, without limitation, any content or other part thereof contains general information only, and is the original content of the owner of this website. It should not be considered as per htmlFor providing advice or any other services. Before deciding or taking action that could affect your money or business, you must show it to the appropriate professional.

We abstain from declaring that the website will be a secured one, free from errors or any viruses or malicious code, and may meet with any particular standard of performance or quality as per customized.

The usage of this website is at the user's personal risk, and the user adheres to anticipate full duty and danger of loss due to your usage, consisting of, without limitations, with respect to loss of factual data or any other data. Any direct, oblique, unique, incidental, consequential, or punitive damages or some other damages in any way, whether or not in a motion of settlement, statute, tort (such as, without challenge, negligence), or otherwise, relating to or springing up out of the usage of this website, should not be the responsibility of the owner of the website.

Without prescribing any of the foregoing, we make no explicit or implied representations or warranties in any way regarding such websites, resources, and gear, and hyperlinks to such a website, sources, and equipment must not be construed as an endorsement of them or their content by using us.

The above-mentioned clauses and renunciations along with the liabilities are subject to the maximum extent as granted by the Law, as in the case of contract, statutes, tortuous liability or otherwise.

Complaint Resolution System

A Complaint Resolution System has been set up as per the Information Technology (Guidelines for Intermediaries and Digital Media Ethics Code) Rules, 2021.

Any complain regarding the digital content on this website should be processed through the Complaint Resolution System via the company website.